01 August 2023

Situation and outlook for feed and fertiliser

The Teagasc Agricultural Economics and Farm Surveys Department published its annual Situation and Outlook for Irish Agriculture last week, which provides an update on the forecast average margins and incomes which are likely across the agricultural sector in Ireland in 2023.

Along with providing the above, the document also details farm inputs and focuses on the current situation and future outlook for feed and fertiliser.

Feed market

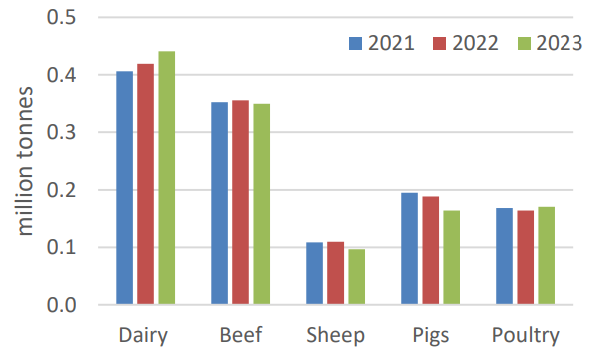

Presenting data from the Department of Agriculture, Food and the Marine (DAFM) on feed sales, which are available for quarter one only, the authors note that bovine feed sales fell by 3% in Q1 2023 relative to the same period in 2022, while dairy feed sales were up 5% in volume terms.

In addition, reductions were noted in the volumes of sheep feed usage – down 12% on the same period in 2022 – which was attributed to higher feed and lower lamb prices for the year to date. On the pig and poultry front, pig volumes were down in Q1 compared to the same period in 2022, reflecting the contraction in the size of the Irish pig population that has occurred, while poultry feed sales in Q1 2023 were up slightly on the same period in 2022.

Figure 1: Compound feed use in Ireland for the first three months of 2021, 2022 and 2023 by the main species (Source: DAFM)

Feed prices

Feed prices thus far in 2023, the authors note, have remained at very elevated levels and are about 15% higher than the same period in 2022. However, it should be understood that Irish feed prices remain about 50% higher than they were during the first half of 2021.

Looking ahead to the rest of 2023, global cereal market developments, as reflected in the ‘on account’ harvest prices reported at harvest 2023, indicate a significant decrease in Irish cereal prices relative to 2022. A 20% decrease in farm-gate cereal prices for the 2023 harvest is forecast.

Despite a forecast decrease in world production of soft wheat and barley in 2023/24, increased global maize production and a higher stocks/use ratio for maize have impacted heavily on the downward movement in feed prices in 2023.

According to the latest report from Strategie Grains (July 2023), world grain markets are now caught in the crossfire between decreasing global harvests for wheat and barley on the one hand, and demand undermined by inflation on the other.

As the feed market moves into the Q4 of 2023, the fundamentals in the market are indicating a reduction in international feed wheat and barley prices. Some market analysts have warned that prices could rise again in the event of further cuts to grain harvests – still a possibility at this stage (especially in Europe for wheat and barley) – and animal sector demand could increase more sharply than currently projected.

There is also significant volatility in the market associated with the cessation of the Black Sea Grain Initiative. However, any sharp rise in prices is unlikely to be sustainable because it would undermine already weak demand. Averaging across the full year, it is likely that Irish farm gate feed prices in 2023 will be approximately 10% higher than in 2022.

Fertiliser markets

Fertiliser prices are influenced by the supply and demand balance in the market, but are also reflective of production costs, which are heavily related to energy prices.

Fertiliser prices rose significantly in 2021, due mainly to a recovery in demand as the COVID pandemic began to recede. Further fertiliser price increases followed in 2022 due to Russia’s illegal invasion of Ukraine and the decline in natural gas availability in Europe, which pushed up natural gas prices and in turn fertiliser production costs.

In 2023, international fertiliser prices have begun to fall, but it can take time for these price reductions to feed through to the farm level. It would appear that much of the benefit of lower farm level fertiliser prices will not be felt in 2023, as much of the fertiliser to be used in 2023 will have been bought at high prices.

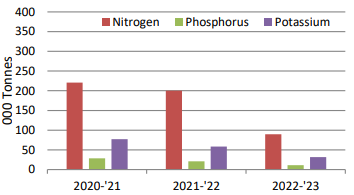

The available official data on fertiliser sales in Ireland covers the first six months of the fertiliser year (Oct 2022 to Mar 2023). For this six month period, there has been a sharp volume decrease in nitrogen, phosphorus and potassium sales relative to the sales levels in the same period in the previous fertiliser year (2021/2022).

Figure 2: Irish fertiliser sales in the first six months of fertiliser years (Oct to Mar) 2021, 2022 and 2023 (Source: DAFM)

Accurate data on fertiliser sales in Ireland in the 2023 fertiliser year will not be available until late 2023. Industry sources indicate that fertiliser sales volumes have recovered as 2023 has progressed. However, the current evidence suggests that grassland farmers in Ireland may further reduce their fertiliser usage in 2023 compared with 2022. Fertiliser use on tillage farms is likely to remain closer to normal, given that reductions in use can easily impact on yields. However, accurate data on this will not be available until late 2023.

Combining a reduction in use, with a 10% fall in prices over the first half of 2023, the expenditure on fertiliser in Ireland will decline in 2023.

To access the full Situation and Outlook July 2023 here.