Dairy finances: 2025 and outlook for 2026

With some uncertainty having entered dairy markets in recent times, Dairy Specialist at Teagasc, Patrick Gowing reflects on the year outgoing and shares key financial tips for the year ahead.

2025, in general, has been a good year for dairy farmers. A number of factors have helped to bring this about. Milk price held for most of the year, stock sale values increased and – for the most part – the weather was good throughout the year.

This combination of factors is likely to bring the average farm profitability on dairy farms up by €400/cow over 2024 levels. In fact, 2025, on average, will likely be the second most profitable year on Irish dairy farms after 2022.

While all this is positive, the markets in the last two months have seen a drastic reduction in milk price due to an oversupply of milk. This was not forecast and shows the volatility of milk pricing over the last five years.

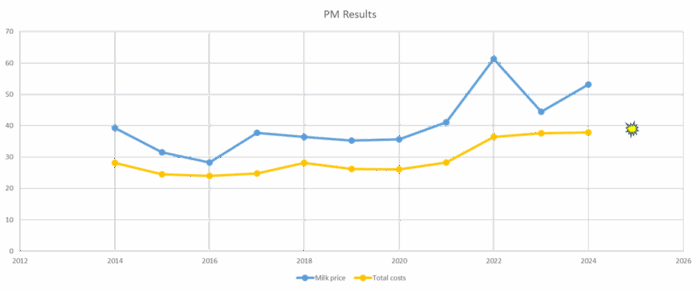

Figure 1: A comparison of milk price versus total costs from Profit Monitor results (2014 to 2024)

As can been seen in the graph above, which compares costs and milk price, we have seen massive variability in milk price since 2021, but a very stable and high level of costs. This is a concern as we head into the spring of 2026, where we are likely to face a lower milk price for the spring initially anyway.

So, what can we do about it? We have to learn lessons from what happened in 2023 and the trends of milk price volatility. The drop in profit in 2023 was directly associated with the drop in milk price as our cost base did not change, in some farms they increased.

Take steps now

Know your costs

Do a Profit Monitor or some other form of benchmarking to see where your farm is. If your costs are high, are you in the right system? Higher cost systems are vulnerable to low milk prices and don’t recover as fast on the upturn. Setting your farm up to maximise the return in the good year is not the most sustainable system going forward, as we don’t react fast enough in the downturn to reduce or costs.

Cost control, cost control, cost control!

Look at all costs. If they are not needed and there is no return from them, take them away from your business. Use the Teagasc Bill of Quantities as a reference if you are over cost in any area.

We see the same things happening annually on farms. Something has to change if we want to break the cycle. An analysis of high and low profit farms in 2023 found that nearly 50% of the difference in profitability was in cost control (in a good milk price year it’s ~35%, so it’s important in a good year also).

Net pasture per cow and grass utilised per hectare

The other key message from the 2023 Profit Monitor analysis was that farmers who maximised the amount of their own grazed grass and their own silage consumed per cow had higher profit margins. It’s a simple concept. It is cheaper to grow your own feed than buy it in. Maximising what you have on your own farm by offering better quality and more of it will maximise your output while maintaining costs. In 2024, 24.5% of the total costs alone were on purchased feed into the yard. It is our largest cost in running our dairy businesses, and it has to be managed especially going into 2026.

Working capital requirement

Retain cash in your business for the coming season. Having a €500/cow cash reserve will carry most farmers over the coming spring. If you have that now but are planning on investing in something that will reduce your reserves below this level, it may not be advisable to proceed from cashflow. Either postpone the investment or potentially look to borrow for it to protect your cash reserve.

Investing in your business is not a bad thing. All businesses require a level of investment. It’s a normal thing. The cycle on some farms at present is that over invest in the good year and regret it in the low-price year that may follow. The investment is good if required by the farm and does not put the farm under pressure in a low-price year.

Move early

If you think you may have an issue, move early to your local Teagasc advisor, accountant or financial advisor. In the past, we’ve seen farmers who put their head down start to run up short-term credit issues. If it is left too long, it can cause more trouble to fix. Moving early will give more options for you, your advisor and potentially the bank.

Focus on the positives

While all the above may seem negative, I think there is a lot of positives we can take going into the 2026 season.

We have done this before in 2023. We know what to expect so we are pre-warned and can react ahead of it. Current accounts are generally in a stronger position today than the were in 2023, as 2024 and 2025 have been good years. The price of surplus stock on farms has increased and is likely to remain favourable into 2026 (increased value of surplus stock was worth ~ 3.2c/l in 2025 over 2024). We also saw an increase in reseeding in 2025, after two wet years, which will stand to farmers next year. Grass quality and clean outs are exceptional around the country, so our platforms are in good condition to have quality grass on farm next spring. This is the year to close with the correct cover to ensure we have grass for the spring.

Listen to this week’s episode of the Dairy Edge podcast, where Patrick Gowing discusses the above in more detail with podcast host, James Dunne:

For more on completing a Teagasc Profit Monitor, visit here.

More from Teagasc Daily: Grassland management for the 2026 spring period starts now